Every Equity Order You Place Deserves the Sharpest Execution in the Market

From structured notes to derivative overlays and risk transformation, FCS Capital Markets delivers custom solutions that match your return targets, risk appetite, and compliance needs.

The Gap Between Portfolio Targets and What Standard Products Deliver

Most institutions know what they need – better returns, controlled risk, and efficient operations. Getting all three without compromise is where things break down in practice.

Targets keep rising, yields keep falling

Traditional safe assets yield too little to meet liabilities or targets. Reaching for yield in the wrong places adds risk you can't afford, leaving portfolios stuck between inadequate returns and unacceptable exposure.

Equity risk without protection

You need growth, but market crashes threaten the capital you're mandated to protect. Direct equity exposure leaves you vulnerable, and managing hedges internally gets expensive fast. One bad drawdown can derail years of careful allocation – and doing nothing isn't an option either.

Single-bank pricing leaves value on the table

Single-bank relationships mean you're stuck with their margins. You don't see what the rest of the market offers, so pricing stays wide and terms stay rigid. Worse, by the time you negotiate better conditions, the window to act has closed.

Strategies too complex to execute alone

The overlay you need involves derivatives, collateral management, and frequent rebalancing. Without in-house structuring expertise, it means juggling trades, tracking margin calls, and managing operational risk that shouldn’t exist.

What You Gain When Structures are Built Around Your Mandate

You need returns that standard assets can't deliver, risk controls that actually work, and strategies that don't collapse under operational weight. We structure the instruments and overlays that make that possible.

Custom structured notes and certificates engineered to your exact payoff targets

Portfolio-level advisory that aligns allocation decisions with risk budgets and return goals

Off-balance-sheet derivative overlays that adjust exposure without disturbing holdings

Securitisation and repackaging that transform illiquid assets into tradable instruments

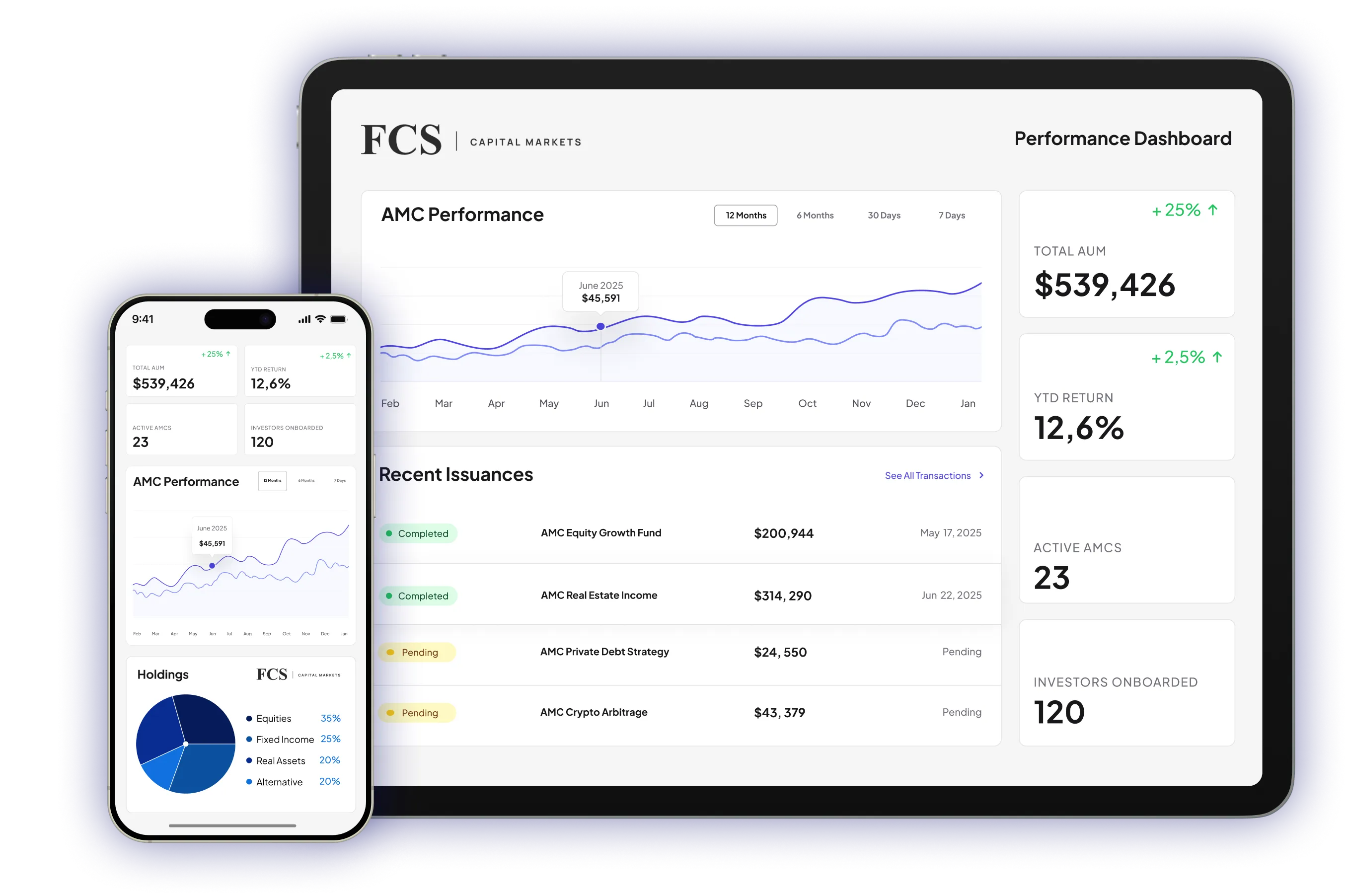

Actively managed certificates that package strategies into exchange-listed structures

How We Move your Strategy From Order Placement to Settlement

From first conversation to final settlement, every stage is built to protect your strategy, secure competitive pricing, and keep the solution aligned with your mandate throughout its life.

Defining the objective

We start by understanding what you're trying to achieve – target returns, acceptable risk, timeframe, and mandate constraints. Your portfolio context matters, so we dig into existing exposures, liquidity needs, and regulatory limits. By the end, the problem is clear: what outcome you need and what structures might deliver it.

Designing the structure

Our structuring team builds solutions using quant models and scenario analysis. We test maturities, strikes, and underlyings to match your target profile. Back-testing and stress-testing show how the structure performs under different conditions, so you see exactly what you're getting before capital gets committed.

Securing optimal pricing

With the structure agreed, we take it to multiple issuer banks for quotes. Each prices based on their view and book, so terms vary – higher coupons, tighter barriers, lower fees. We compare offers, negotiate where possible, and select the best.

Execution & implementation

Once terms are locked, we coordinate issuance through the chosen bank or insolvency-remote SPV. The note gets an ISIN, Euroclear settlement, and exchange listing if needed. We handle documentation, settlement logistics, and custody delivery. You receive a turnkey solution that's operational from day one.

Ongoing monitoring & management

Once live, we track performance regularly – mark-to-market values, barrier distances, coupon accruals, corporate actions. You receive regular reports, and we check valuations using independent models to ensure fair pricing. If market conditions shift or exposures drift, we flag it proactively rather than waiting for you to notice and call.

Exit or adjust

If you need to exit early or adjust exposures, we facilitate it. We source secondary quotes from issuers or dealer networks and coordinate unwinds. When strategies need modification – adding protection, rolling positions, hedging new risks – we design overlays or amendments that keep solutions aligned with your mandate.

Maturity & reinvestment

At maturity, we ensure payout is calculated correctly and delivered on time. Then we engage on what's next – rolling proceeds into a new structure, rebalancing exposures, adjusting strategy. This creates a continuous advisory loop rather than one-off transactions, so your portfolio evolves alongside objectives and market conditions.

We Know Different Portfolios Face Different Pressures

Pension liabilities don't move with markets. Insurance capital rules shift. Asset managers need alpha. Each mandate brings unique constraints – and needs solutions built for them.

Asset & investment managers

Your clients expect differentiated returns, yet mandates limit what you can hold. Traditional fund setups take months and add cost. You need AMCs that wrap strategies into tradable formats, overlays that refine portfolio risk, and structures that generate alpha without breaching UCITS guidelines.

Hedge funds & alternative asset managers

Speed and discretion define your edge. You need customized derivatives for bespoke views, leverage without heavy prime costs, and execution that doesn't broadcast your strategy to the market. Correlation swaps, custom baskets, and tailored hedges for concentrated positions demand partners who move fast before opportunities fade.

Wealth managers & private banks

Your clients want returns that beat deposits, but won’t tolerate large drawdowns. You need capital-protected notes with upside, yield-linked certificates reflecting their views, and products simple to explain yet powerful in delivery. When every bank offers similar portfolios, bespoke structures become the way to stand out.

Corporate & institutional treasuries

You're hedging FX from overseas revenues, locking in rates on debt, or earning more on surplus cash without taking unacceptable risk. Single-bank relationships leave you stuck with their pricing. So you need tailored overlays that cut hedging costs, structured deposits that boost yield, and solutions that don't load up the balance sheet.

Insurance companies

Low yields make it hard to meet guaranteed returns and profit goals, while Solvency II inflates capital charges. You need credit-linked notes for better spreads, capital-protected structures that let you access growth markets, and securitisations that shift risks off your balance sheet entirely when regulations demand it.

Pension funds

Long-dated liabilities meet low-yielding assets, and funding gaps show up fast. You need structures that match payouts, hedge rate risk, and deliver returns without breaching trustee limits. That means liability-driven overlays, capital-protected notes, and swaps calibrated to your schedule, not generic products.

Solutions are Built

Around Your Mandate

From onboarding to issuance, our streamlined SPV process removes delays, eliminates issuer risk, and ensures your AMC is compliant, Euroclear-eligible, listed, and investor-ready in weeks.

Returns that match your risk budget

Bespoke structures let you enhance yield by taking on carefully defined risks rather than blindly reaching for credit or duration. Barriers and conditional triggers mean you boost income where it makes sense, improving risk-adjusted returns without loading up on exposures your mandate can't handle.

Downside protection when markets break

Capital-protected structures keep you invested in growth assets while capping losses to levels your mandate can handle. Minor market dips don't erode capital, and tail-risk overlays provide cushion during severe corrections. So you participate in upside without the drawdowns that breach risk limits or trigger regulatory issues down the line.

Access to markets you can't reach directly

Securitisation turns illiquid exposures – real estate, private equity, emerging credit – into tradable notes. Multi-asset structures combine uncorrelated payoffs that standard products simply don't offer. That expands your opportunity set and improves diversification without operational complexity piling up on your desk.

Pricing that actually competes

Multi-issuer competition drives down margins and delivers tighter option pricing or higher coupons than single-bank quotes. Running competitive tenders means you capture savings that compound across the portfolio. Better pricing translates directly into performance – basis points you keep instead of giving away to one dealer.

Why Professional Investors Choose

FCS Capital

One bank means one price, one product shelf, and limited flexibility. FCS Capital brings multi-issuer access to every structure, competitive pricing by design, and unbiased advice that lets solutions compete on every level.

Success Stories That Speak for Themselves

Built by Market Professionals for Professionals like You

Institutions kept running into the same problem: structured solutions that were either too generic or too slow. FCS was built to bridge that gap – traders, structurers, and quants who've worked both sides and know what actually works when portfolios need more than standard products can deliver.

Let's Build the Structures that Match Your Mandate

You need returns traditional assets can't deliver and protection that actually holds. We design the structures that make both possible – tailored to your objectives, priced competitively, and built to perform.