Professional Derivatives Execution With Institutional-Grade Market Intelligence

FCS provides institutional investors with tailored derivatives solutions - rooted in research, guided by experience, and delivered with the efficiency of modern technology.

The Obstacles Between your Investment Ideas and Confident Derivatives Execution

Behind every trade lies an operational, collateral, liquidity, and legal framework. Each can slow execution, distort outcomes, or increase risk if not handled with discipline.

Infrastructure not built for derivatives

In volatile markets, shifts in collateral needs can create added liquidity and operational demands. If collateral is not managed efficiently, valuable assets may be locked up unnecessarily, limiting flexibility for investment or risk-management decisions.

Collateral pressure in volatile markets

A sudden margin call can drain liquidity overnight. Add the heavy initial margin rules under UMR, and portfolios get weighed down further. The wrong collateral choices then tie up cash or bonds that should be working, dragging on returns.

Liquidity that proves unreliable

Markets look liquid until you need to move size. Big blocks move markets, spreads widen, and with too few dealer relationships, pricing suffers. When conditions turn stressful, that “liquidity” disappears right when the hedge is most needed.

Documentation that delays execution

An idea may be time-sensitive, but the paperwork rarely is. ISDA terms stretch for months, CSAs and clearing agreements pile on, and regulatory filings eat up time. By the time it’s signed, the window to act is often gone.

What you Gain When Risk and Opportunity are Structured for You

Investors want clarity in volatile markets, reliable execution across venues, and support that anticipates problems before they arise. Delivering that requires depth and precision. That’s the standard we hold ourselves to.

Market intelligence with on the ground insight into regional flows and trading behavior

Advisory support grounded in derivatives expertise and quantitative strategy design

Wholesale execution across off exchange markets with access to deep global liquidity

Agency execution that protects client anonymity and secures best possible outcomes

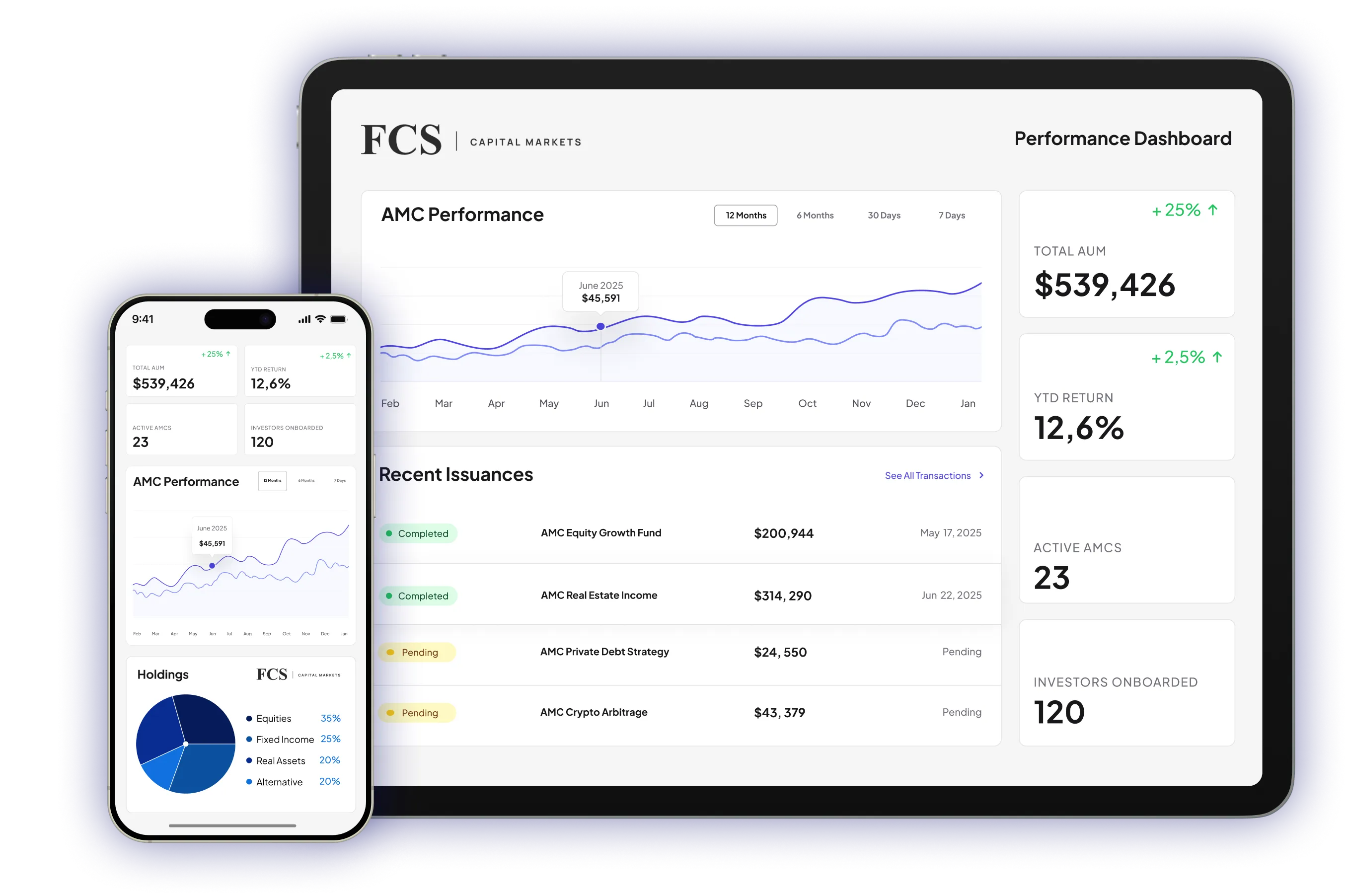

Technology platforms delivering live pricing market analytics and transparent control

How We Take your Derivatives Strategy from Order to Execution and Beyond

Derivatives only deliver value if every stage is handled cleanly. That means strategies built with data, trades executed with discretion, and lifecycle details are never left unchecked.

Strategy development & product selection

A trade starts with a clear purpose, whether the goal is hedging, generating yield, or taking tactical exposure. From there, the idea is refined into the most effective structure using quantitative models and scenario analysis to test maturities and strikes. Risk checks confirm mandate alignment, leverage usage, and position limits before anything goes to market.

Order placement & execution

Execution flow through electronic platforms, RFQs, or direct dealer networks across listed and OTC markets. Smart routing protects anonymity and searches for the best terms, with every step documented for MiFID II best execution.

Trade clearing

Once executed, trades are captured, confirmed, and sent to clearing or bilateral settlement, depending on product type. Margin requirements are managed through clearing brokers, with daily variation and initial margin workflows, and straight-through workflows handle both variation and initial margin, with EMIR and MiFIR reporting built in.

Ongoing lifecycle management

Once live, positions are monitored daily for margin calls, collateral shifts, corporate actions, expiries, and resets. Clients receive clear reporting on P&L, Greeks, VaR, and stress tests through dashboards designed to keep exposures visible and conversations proactive.

Trade closure & final settlement

When trades are unwound, positions can be closed through market-maker networks or compression in OTC books. Settlement may be cash or physical, with reconciliations and margin release handled promptly. Each trade ends with a client review to assess performance and refine the next strategy.

We Know That Every Industry Demands Its Own Precision

Different market participants face different pressures - managing liquidity, capital risk, or regulation, each require derivatives expertise that adapts to their objectives.

Hedge funds

You rely on derivatives to protect against tail events or to take tactical positions quickly. Speed and liquidity matter most, especially across markets and geographies. If you run a mid-sized fund, external infrastructure and strategic input can give you the reach and support usually reserved for much larger players.

Asset managers

As an asset manager, you use derivatives to hedge equity or currency exposure, or to equitize cash when markets move. Compliance under UCITS and similar regimes leaves no room for shortcuts, so transparency and reporting are just as important as execution. When trades run into large notionals, you need scale, clear reporting, and execution you can trust.

Pension funds & insurance companies

If you manage a pension or insurance balance sheet, your trades are fewer but much larger. You use swaps and futures to hedge rates, inflation, or longevity risk. So clearing exemptions, shifting margin rules, and liability-driven overlays make guidance as important as the execution itself.

Corporations & corporate treasuries

Running a corporate treasury means hedging FX, rates, and commodities tied to your business. You want pricing that isn’t locked to a single bank and instruments that are plain, transparent, and low on collateral impact. Above all, you want certainty in how risk is managed day to day.

Execution Built Around your Priorities

Absolute anonymity

You never compete with us for flow. Your orders are handled under a pure agency model, with identity shielded when canvassing dealers. That keeps market impact low and ensures pricing and liquidity are always aligned to your interests.

Local knowledge, global reach

When you deal across regions, you need more than a screen. Our sales traders embedded in local markets provide live color and context, giving you access to liquidity pools worldwide. Trading at the source helps you secure levels and flows that a single venue can’t offer.

Wholesale & off-exchange execution

Big blocks and negotiated OTC trades demand discretion. We handle those trades carefully, then ensure they’re booked, cleared, and reported the right way. Off-exchange execution and regulatory obligations are managed without slowing the process.

Advisory you can rely on

When option strategies get complex, you have on your side experienced traders and strategists who have built and managed derivative structures themselves. From volatility and skew to strikes and maturities, the advice you get is shaped around your objectives, not off-the-shelf ideas.

The Gap Between Average and Expert Execution Shows Up In your Returns

Every order is more than a trade – it’s alpha at risk. That’s why we protect anonymity, source liquidity across venues, and add trader judgment where algorithms alone fall short.

Success Stories That Speak for Themselves

Built by Market Professionals, for Market Professionals Like You

FCS was founded to solve a recurring problem: institutions needed derivative solutions that were global in reach yet disciplined in execution. Clients want transparency, anonymity, and liquidity without operational drag. We answer with market color, agency execution, and technology that manages trades end to end.

Clarity in Volatility. Discretion in Execution. Confidence in Every Trade.

Institutions investors seek liquidity, anonymity, and disciplined execution without operational drag. FCS delivers derivatives strategies grounded in market color, agency execution, and technology that scales with demand.