Precision and Discretion in Every Fixed Income Trade

Access investment-grade products, government, financial, and corporate bonds with agency execution that protects your strategy, sharpens pricing, and delivers trades across global markets.

The Obstacles Between your Bond Strategy and Clean Market Execution

Bond markets look simple on the surface, but hidden frictions can erode results. From uneven pricing to fragmented access, every trade carries risks you can’t afford to ignore.

Prices that don’t tell the full story

In bonds, the “market price” is often just a starting point. Quotes vary across dealers, and what you see on a screen rarely matches where trades actually clear. That gap makes it hard to know if you’re paying too much or leaving value behind.

Liquidity that disappears when size matters

Screens suggest depth, but size tells a different story. A large order can move prices against you, and in stressed markets even benchmark bonds can go quiet. What looked tradable quickly becomes hard to shift without cost.

Access split across too many venues

There isn’t one marketplace for bonds. Liquidity sits across countless venues, platforms, and dealer lists. If your access is narrow, you only ever see part of the picture, and opportunities slip past without you knowing.

Credit risk that isn’t what it seems at first glance

Credit stories don’t always show up in ratings on time. A bond can look solid until a downgrade or hidden covenant changes the picture. Without the right flow of information, you can end up holding risk you didn’t intend.

What You Gain When Fixed Income Execution Is Built Around your Strategy

Bond markets demand more than access. You need coverage across instruments, execution that protects your trading objectives, technology that finds liquidity others miss, and insight that turns opaque pricing into decisions you can act on.

That’s the standard we hold ourselves to.

From government bonds and corporates to emerging debt and structured credit, you can trade the full spectrum of instruments, accessing liquidity in both liquid and harder-to-source markets.

Orders are worked across venues and dealer networks with anonymity and discretion, ensuring you capture liquidity without moving the market or exposing your intent to competitors.

Smart order routing, evaluated pricing tools, and direct connectivity to trading platforms give you real-time comparisons, quicker responses, and cleaner trade outcomes.

Access investment grade products, government, financial and corporate bonds with agency execution that protects your strategy, sharpens pricing, and delivers trades across global markets.

Market color and relative value insight shaped by dual buy side and sell side expertise giving you clarity on pricing spreads and strategies before you trade

How We Take your Fixed Income Trades From Idea to Settlement

Bond markets only deliver when every stage is handled cleanly. That means onboarding without friction, orders executed with care, and settlement that leaves no detail unchecked.

Onboarding & account setup

Before you can trade FCS carries out full KYC checks in line with regulatory requirements. This means KYC, due diligence, and legal terms are completed upfront, along with custodian details and settlement instructions. Once connected, you gain direct access to trading channels, whether through voice, secure messaging, or electronic systems.

Needs analysis & bond selection

Once onboarded, the conversation shifts to what you’re trying to achieve. Whether it’s yield, duration, or liability matching, sales and trading teams analyse options and share market color. Pricing runs, yield-to-maturity, and credit spreads are reviewed to ensure the security fits your mandate while compliance confirms suitability and transparency.

Pricing & order placement

When you’re ready to trade, orders are placed by ISIN or CUSIP with size and limits agreed. Requests for quotes are sent across multiple platforms and dealer networks, or negotiated directly in less liquid names. Throughout, your identity is kept hidden to avoid market impact. Once terms align, the desk confirms the order and locks in execution under best execution standards.

Trade execution & confirmation

Once a price is agreed, the order is executed either electronically or OTC. A confirmation is issued immediately with full details: ISIN, size, price, yield, accrued interest, and settlement instructions. Compliance obligations under MiFID II are built into the process, ensuring best execution is demonstrated and every step is captured for regulatory records.

Settlement clearing & delivery

After execution, operations coordinate settlement across Euroclear, Clearstream, CREST, or DTC depending on the bond. Delivery-versus-payment ensures cash and securities exchange simultaneously, reducing counterparty risk. Any mismatches or settlement issues are resolved quickly, so your trades close on time and your portfolio reflects the new position without delay.

Post settlement & reporting

Once settled, you receive clear confirmation that the trade is complete. Positions are updated, and reporting is delivered to meet your requirements, from trade tickets to transaction cost analysis. For larger or more complex trades, market impact is reviewed. Each detail is reconciled, giving you confidence that the trade is clean, compliant, and accurately recorded.

We Know That Every Industry Demands Its Own Precision

Every institution approaches bonds with different goals in mind. Some focus on income, others on risk control or speed. What unites them is the need for clarity, liquidity, and execution they can rely on when markets get difficult.

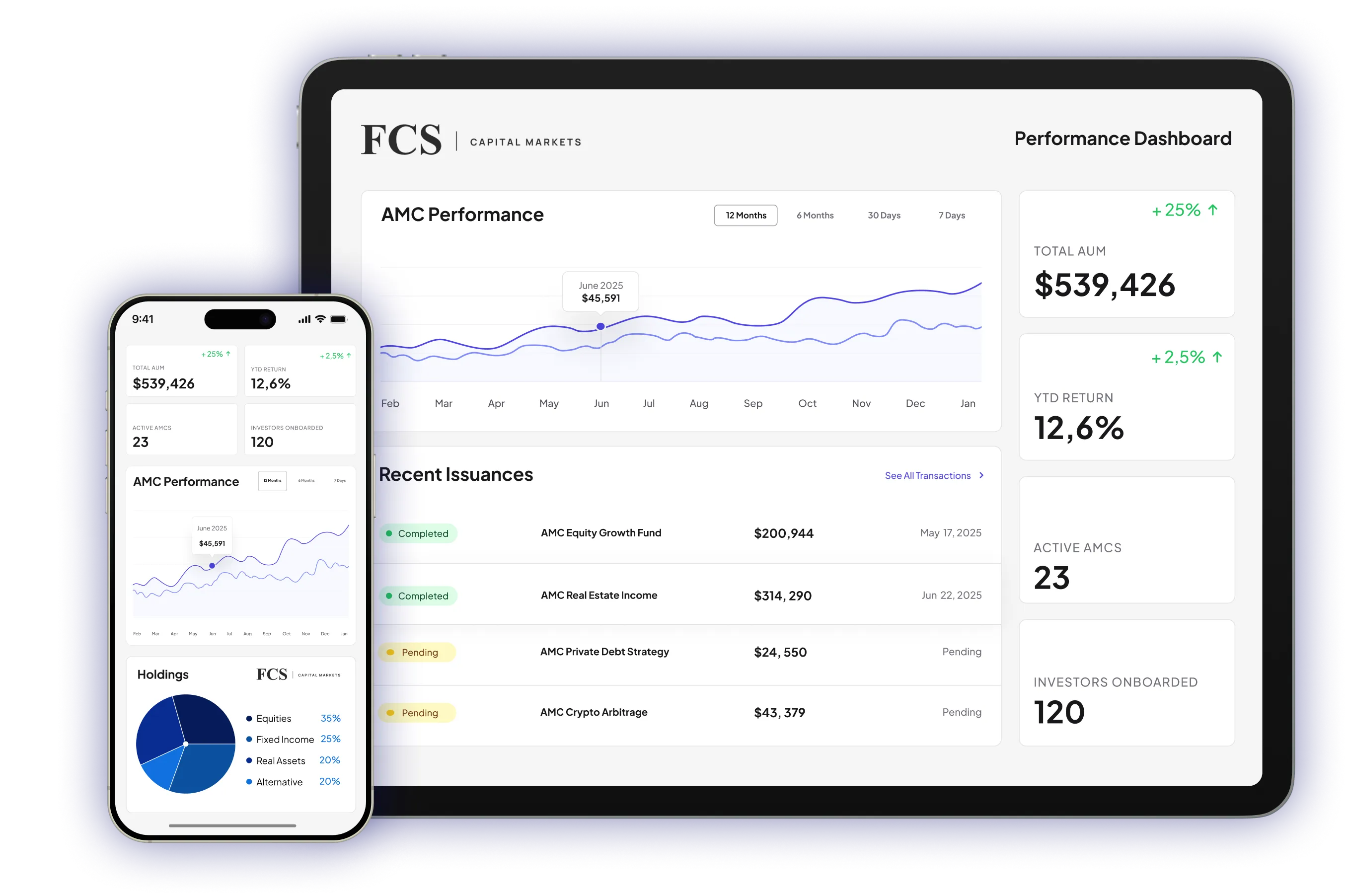

Asset managers

Running diversified portfolios means dealing with large volumes across different geographies and sectors. You need liquidity you can rely on without exposing your strategy, and execution that doesn’t create tracking error. Whether it’s reallocating to meet benchmarks or finding relative value, you need a desk that extends your reach without slowing you down.

Pension funds & insurance companies

Your focus is on meeting long-term liabilities and keeping capital secure. That calls for long-dated government bonds or high-quality corporates in meaningful size. Duration gaps, reinvestment risk, and regulatory charges make each allocation decision critical. You need execution that can secure large blocks quietly while keeping portfolios aligned with obligations.

Hedge funds & trading firms

Opportunities in credit and rates often appear quickly and vanish just as fast. You need prices in real time, anonymity when working size, and access to liquidity even when it’s scarce. Whether you’re hedging exposure, trading relative value, or exiting a distressed position, execution has to be fast, discreet, and supported by market insight.

Private banks & wealth managers

Your clients expect portfolios that deliver income and preserve value without hidden costs. That means accessing new issues, finding liquidity in odd-lot sizes, and showing fair pricing at all times. You need execution that protects trading objectives, competitive fills across venues, and reporting you can stand behind when explaining results to clients.

Execution Built Around your Priorities

Absolute anonymity

When you move size in bonds, the last thing you want is the market shifting against you. Every order is handled under a pure agency model, with your identity shielded at all times. Whether canvassing multiple dealers or using dark pools, the focus stays on discretion so your strategy remains protected.

Local knowledge, global reach

Bond markets don’t trade the same way everywhere. Accessing Eurobonds, Gilts, Treasuries or Emerging Credit requires relationships across regions. Our traders bring experience from major markets and connect you directly to the flows that matter, giving you reach into global liquidity with the judgment to interpret it in real time.

Liquidity where you need it most

Government issues may be straightforward, but corporate, high yield, and emerging debt often aren’t. By tapping multiple dealers, inter-dealer platforms, and crossing networks, we source liquidity even in bonds that rarely trade. That means you can get large blocks done with less impact, instead of leaving orders stranded.

Advisory you can rely on

Execution alone isn’t enough – you also want ideas grounded in experience. Our team draws on both buy-side and sell-side backgrounds to provide market color, relative value analysis, and strategies for yield, hedging, or duration. That perspective helps you see opportunities before they become obvious to the wider market.

The Difference Expert Fixed Income Execution Makes

Bond markets are opaque and fragmented. Getting trades done well comes down to reach across venues, discretion in execution, and independence from conflicts.

Success Stories That Speak for Themselves

Built by Market Professionals, for Market Professionals Like You

Fixed income is a market that rarely shows its hand. Prices are opaque, liquidity shifts quickly, and settlement leaves little room for error. Our team has spent years on both sides of these trades, and we know the difference between surface quotes and real access. That perspective shapes the way we approach every order – discreetly sourcing liquidity, working prices with care, and seeing settlement through without compromise.

Transparency in Pricing. Discretion in Trading. Precision in Settlement.

Fixed income investors face opaque pricing and shifting liquidity. FCS provides agency-only execution, dealer access across sovereign, corporate, and emerging debt, and settlement you can rely on – so every trade reaches the market cleanly.